The Complete Picture of Equipment Cost Management

There is certainly nothing wrong with a focus on cost reduction. However, by looking at machine costs and machine aging together, contractors can make smarter decisions about just how much to spend on their fleet and where best to spend it.

There is certainly nothing wrong with a focus on cost reduction. However, by looking at machine costs and machine aging together, contractors can make smarter decisions about just how much to spend on their fleet and where best to spend it.

The costs of owning and operating heavy equipment are two separate but related expenses. They should both be actively captured and managed, but the best equipment managers take it one step further. They put these costs back together for all the different machines in their fleet and use this combined data to identify “the sweet spot” — the point at which total marginal cost of machine ownership starts to go up.

Operating Costs

It is no surprise that the costs associated with construction equipment operation go up over time. Replacement of wearable parts such as gaskets, belts, brakes, tires and treads can be predicted with a fair degree of accuracy and occurs with relatively constant frequency. The reason that operating costs increase over time, of course, is simply that as equipment ages it becomes less efficient and more prone to failure. Fuel economy decreases, oil consumption increases and repairs become more frequent.

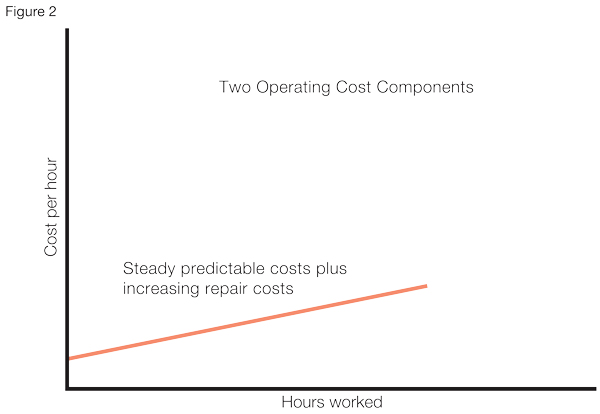

Research1 has shown that, in general, one can model the rate of operating costs for fleet equipment by combining a steady rate with one that increases steadily over time.

Research1 has shown that, in general, one can model the rate of operating costs for fleet equipment by combining a steady rate with one that increases steadily over time.

Figure 1 shows this simple model. The steady rate corresponds to the expected wear down and replacement of parts, while the increasing rate is due to the aging that accompanies ever-increasing usage hours. The values for the rates shown — the specific numerical values for “A” and “B” — will vary for every different type of equipment. But they can be derived by regularly recording field measurements of all major operating costs for all heavy equipment.

Owning Costs

It is a well-known maxim that the value of a new vehicle decreases dramatically as soon as the front tires leave the dealer’s lot. The same is certainly true of construction equipment, but more than just depreciation needs to be taken into account when considering the cost of ownership. Other costs include licensing, insurance, interest on payments and the property taxes associated with owning a fleet.

The residual value of a machine — the amount a contractor can recover through resale — is perhaps the single most relevant figure in the calculation of ownership cost. A piece of equipment can be sold at any point in its life and some fraction of its purchase price can be recovered. Not selling it means forgoing that recovery and, from the standpoint of capital expense management, means a cost to the company. Of course, the idea is that the benefit received by holding on to the equipment is more than making up for this cost.

There is one other component to the cost of ownership that is often disregarded. The number of hours a machine is in active use has a significant impact on the length of time of its useful economic life. So while a number of ownership cost parameters are fixed with the terms of the initial purchase, the use of the machine over time impacts the way owning costs are distributed over time.

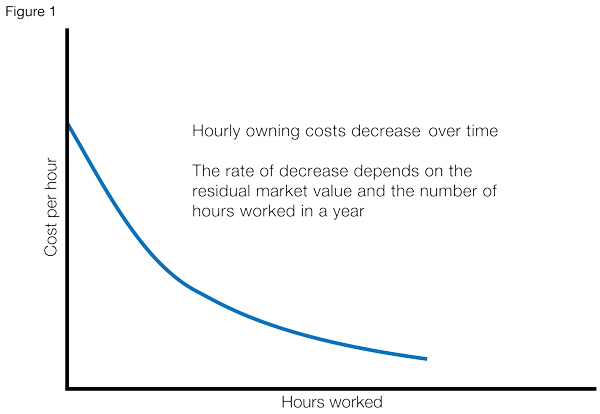

Figure 2 shows a typical curve for the rate of ownership cost. The steep then more gradual decrease is a function of depreciation as the equipment approaches the end of its useful life and residual value decreases. Of course with fixed costs such as insurance and licensing, the curve will not reach zero.

Figure 2 shows a typical curve for the rate of ownership cost. The steep then more gradual decrease is a function of depreciation as the equipment approaches the end of its useful life and residual value decreases. Of course with fixed costs such as insurance and licensing, the curve will not reach zero.

The Whole Picture

The management of owning and operating expenses usually falls to different groups and individuals within an organization. This division is natural given the different skills and responsibilities that go along with the management of capital versus construction operations. It goes without saying that a contractor should make sure that both disciplines are executed as efficiently as possible. The right equipment should be purchased or leased under the best terms possible, then scheduled for use and maintained with expertise.

However, even when all this happens, one important question remains: How long should a machine in the fleet be kept in operation? To arrive at an answer, a contractor must do two things: manage costs over time and look at the combination of owning and operating costs.

In the project-oriented and tight margin construction industry, it is easy to focus on immediate costs. With reference to Figures 1 and 2, this means just looking at the height of the curves at individual periods of time instead of considering how they change over time. When one knows how they change for different equipment types across their lifetimes, one is equipped with a new dimension of information to help make smart fleet management decisions.

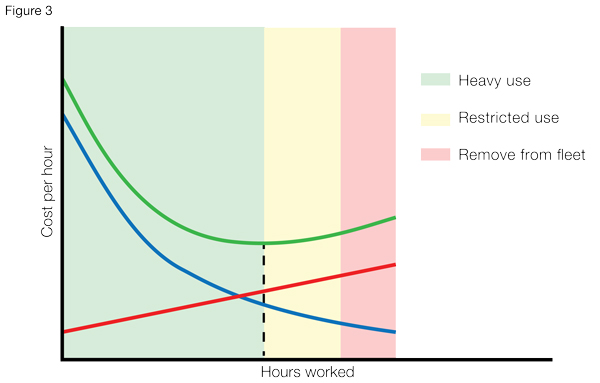

Perhaps the most important of these decisions is determining the optimal lifetime for equipment in the fleet. By looking at the combination of owning and operating costs over time, contractors can see the whole picture of equipment cost performance and see when it makes sense to consider retiring individual machines.

Consider Figure 3 in which the sum of the owning and operating cost curves is shown.

Consider Figure 3 in which the sum of the owning and operating cost curves is shown.

As owning costs decrease and operating costs increase, there comes a time when the marginal costs of using a piece of equipment starts to rise. This flat point in the combined cost curve is the “sweet spot,” identifying the time after which the marginal benefit of using the equipment will continue to decrease, and the cost point at which the equipment achieves its greatest utility. It is at this point that use of the equipment should likely be scaled back and consideration be given to its eventual sale.

Taking Action

Establishing a total picture of equipment cost means knowing what information to gather, collecting that information over time, creating performance benchmarks and then analyzing data with reference to the benchmarks. To do all of this, a contractor needs knowledge, process and tools.

There are a number of resources available to learn more about the details of managing owning and operating costs and how to use cost information to your advantage. One such resource is the Construction Equipment Management Program, from which many of the concepts in this article have their source. More information on the program can be found at www.cempcentral.com.

Before looking for data tools and software, it is important to establish the business processes that will support data collection, benchmark creation and the actions that should occur when performance falls short of expectation. A process work flow should be defined that includes the types of cost data that need to be regularly captured. And if individuals are not assigned to specific elements of the work flow such as field data gathering or cost curve analysis, then there will be little or no return on any investment in software tools or training.

Finally, look for tools that support your equipment management work flow. Investigate the growing number of mobile apps that record field data, supplementing the information delivered by built-in equipment telematics. Re-evaluate construction operations software to see if it offers or integrates with mobile apps and if it provides the analytical tools that help process equipment data.

Whatever processes are put in place or tools employed, the end result should be a complete picture of the true costs of buying and using construction equipment. Equipped with complete information, contractors can make well informed decisions that optimize the utility of their fleet and result in improved bottom line performance on their jobs.

John Chaney is President and Co-Founder of Seattle-based construction software provider Dexter + Chaney. He can be reached at jchaney@dexterchaney.com, and more information on the company can be found at www.dexterchaney.com.

1. Construction Equipment Management Program (www.cempcentral.com)