It’s a VUCA World… What’s a Utility Contractor To Do?

2023 Utility Outlook Executive Summary

By Mark Bridgers, Cam Winstead, and Virginia Bellenekes

VUCA…Volatility, Uncertainty, Complexity, and Ambiguity. In hindsight, the period from approximately 1985 to 2020 was remarkably stable using nearly any economic or market measure. COVID-19 and the subsequent lockdown, supply chain challenges, geopolitical conflicts, political instability, cascading inflation, potential recession, etc., have ushered in a VUCA period that perhaps will look more like the economy, markets, and geopolitical landscape from the early 1970s to early 1980s where high inflation, high interest rates, recession, and geopolitical conflict, yielded slow economic growth and turmoil. What’s a utility contractor to do? VUCA…Vision, Understanding, Clarity and Agility are the tools to cope and adapt in this environment. With all that said, there is significant opportunity and growth available in all of the utility construction markets – electric, gas, water, sewer, and broadband for innovative and transformative leaders and companies. Are you one of them?

Utility Spending Forecast

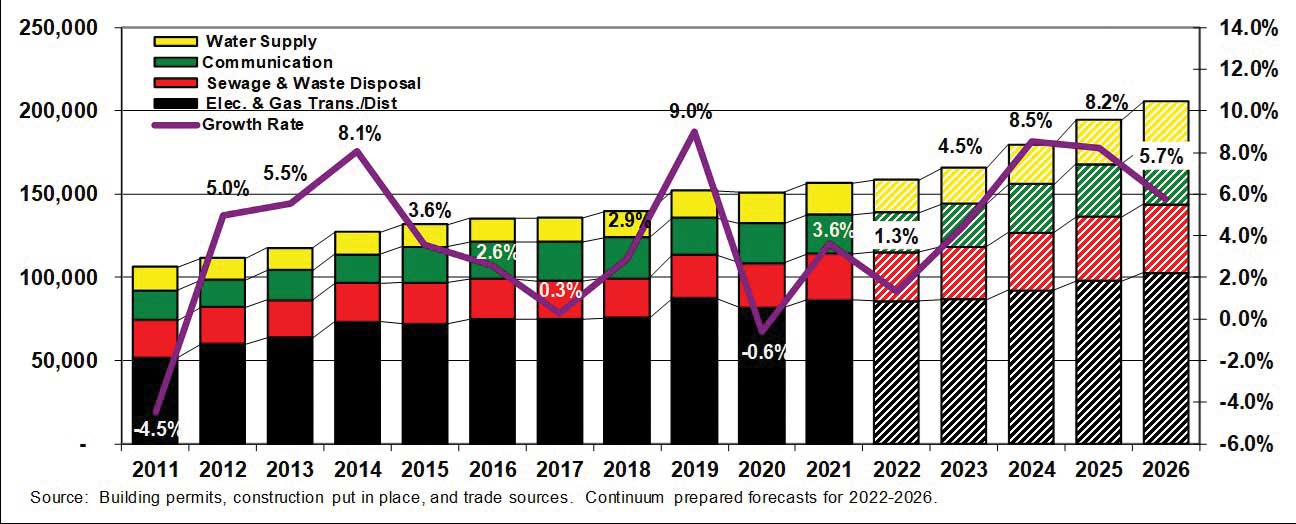

The pandemic is over but we are left with the aftermath, VUCA. Spending growth in 2020, 2021, and 2022 is essentially flat given the shutdown and supply chain challenges. The passage of the Infrastructure Investment and Jobs Act (IIJA) and Inflation Reduction Act (IRA) along with underlying safety and customer demand driven construction activity is going to result in much faster growth in 2024. While the authors expect a short and shallow general economic recession in 2023, all of the utility construction markets will exhibit a floor of activity which will support these markets even in a more severe recessionary period.

Transmission & Distribution – Electric, Gas & Liquid

VUCA…where to begin…the long-haul liquid and gas pipeline market is being savaged; the gas distribution market is under relentless attack; electric reliability and undergrounding is all the rage; and total electrification will require a rethinking and likely reconstruction of transmission infrastructure. The mixture of challenge and opportunity yields a return to growth in 2023 and beyond.

The electric, gas, and liquid market are perhaps in the greatest transformation in their history. Vision, Understanding, Clarity and Agility are the necessary tools for a contractor to cope. Some examples:

- Agility: New natural gas connection bans began in California and have been adopted in multiple states. There is push back however and agility to know where to stand, when to move, and where to go will be critical in this market space.

- Clarity: It is the belief of the authors that we have turned a corner and the pursuit of a “green” future and electrification of [mostly] everything will take place…the question is on what timeline. Building clarity for your firm and management team and how this will play out, perhaps using a series of scenarios, will be critical to positioning your firm for the future.

- Understanding: The acceleration of undergrounding of electric infrastructure is forcing a rethinking of the cost versus benefit and for many contractors the learning of a new vocabulary. Conventional wisdom was that it is too expensive to underground. In a recent study, Paul Gogan of WEC Energy Group described a radical change in undergrounding strategy: “When I first started in distribution engineering…the thought process was to harden and underground your main line…[Our approach now] is just the opposite.” Understanding your customer’s thinking and needs will be critical in this environment.

- Vision: The gas/liquid pipeline market is perhaps in the most turmoil. For firms and leaders with vision, a “Three Gas Future” offers promise.

- Natural Gas – As a clean fuel to replace coal and augment wind and solar renewables to yield something more like dispatchable power from renewable sources – Will also have to be paired with storage, likely at or near the renewable generation point.

- Carbon Dioxide – As a capture result from various forms of power generation or manufacturing to reduce carbon emissions.

- Hydrogen – As a clean fuel, as a storage tool, as a fuel cell, blended into natural gas systems as a method to reduce carbon emission and avoid stranded pipeline and distribution assets.

Water Supply & Sewage and Waste Disposal

Will the federal funding associated with water and sewer construction activity meet demand for the installation of new system components and replacement of others? The short answer is no, but the combination of federal funding and unexpectedly flush state and municipal budgets will result in one of the most robust growth rates exhibited in both the water and sewer markets in over a decade. The supply chain challenges and compliance with the federal funding requirements will slow the implementation of spending in 2023 after which faster growth will occur. Ultimately, this Federal, State, and Municipal spending forms a floor under this market that will make it recession resistant and is also the source of the rapid growth, even if the U.S. enters a recession in 2023.

When asked why he robbed banks, Willie Sutton is supposed to have said “Because that’s where the money is.” Innovative leaders look to position their firms where work will take place in specific markets or geographies. The removal of lead service lines is one of these markets. Go to where the money is!

Broadband

The broadband market exhibits regular growth in spending post 2012 in a long-term trend that is unprecedented looking back in time to the early 1990s. The demand for streaming, wireless data usage, and other data intensive services has grown exponentially and lack of fast service and rural access was made abundantly clear during the pandemic resulting in massive government funding specific to broadband infrastructure. “The Bipartisan Infrastructure Law will deliver $65 billion to help ensure that every American has access to reliable high-speed internet through a historic investment in broadband infrastructure deployment.” This spending paired with insistent demand forms a spending floor under this market that will make it recession resistant and is also the source of rapid growth described.

One issue that was particularly problematic during 2022 and is slowly being resolved is access to broadband materials and equipment for installation in construction. While workforce availability remains the primary constraint in this market, materials/equipment availability has and will continue to slow potential spending growth rates.

Overall Conclusions

The flip side of the risks and challenges is significant opportunity for innovative and transformative leaders who through vision and passion position their firms to secure the growth and opportunity available. The VUCA environment will punish firms who sit still and the choice to pine for the stability of the past and take no transformative action, is, in this writer’s opinion, the only wrong choice. As you prepare your strategy, tactics, business plans, and teams for 2023 and 2024, use the tools of Vision, Understanding, Clarity & Agility to define your actions. Fortune favors the bold…will you lead and transform or be left behind?

Mark Bridgers, Cam Winstead, and Virginia Bellenekes are consultants with Continuum Capital, which provides management consulting, training, and investment banking services to the worldwide energy, utility and infrastructure construction industry. They can be reached at (919) 345-0403 or MBridgers@ContinuumCapital.net and followed on twitter at @MarkBridgers. For more information on Continuum, visit www.ContinuumCapital.net.