NUCA Assurance: Now More Control Over Your Insurance Programs New Member Benefit Available For 2023

In 2023, each NUCA member can now join other like-minded NUCA contractors who want to take control of their claims, manage their risk, and secure better focused insurance services for their businesses.

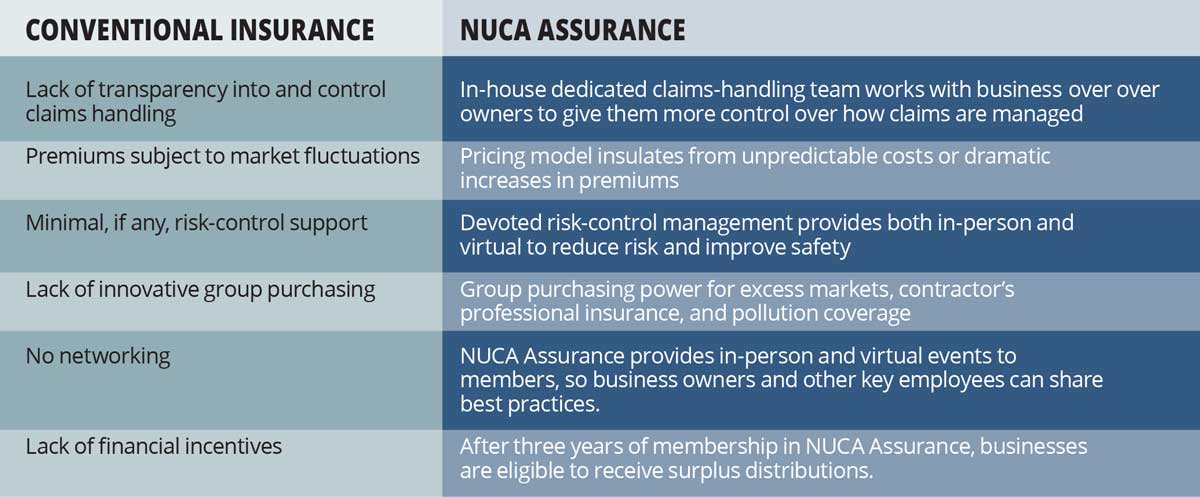

NUCA is introducing NUCA Assurance, the new group captive program available exclusively to NUCA members. NUCA Assurance is a construction-focused group captive program owned by NUCA members and offers a host of insurance benefits to business owners.

It’s designed by insurance experts with construction backgrounds to deliver the claims control and risk-management to support smart business owners.

NUCA members are now able purchase workers’ compensation, general liability, auto liability and auto physical damage insurance through the NUCA Assurance program.

“Members using NUCA Assurance are going to have more control over their insurance programs,” said Doug Carlson, NUCA Chief Executive Officer. “NUCA members participating in this program are eligible to receive distributions after three years. It’s a win-win for every NUCA member who signs up.”

Every participant in the program is measured against pre-established, captive-specific best practices and receives customized risk-control offerings to bolster jobsite safety. Risk management includes both in-person and online training and support. NUCA Assurance also provides members a low-cost program with Lytx and Samsara, which are industry-leaders dashboard-camera monitoring in fleet vehicles to provide clear insight to accident timelines.

In addition, members have a dedicated claims team to advocate for them whenever a claim occurs. The result is fewer reported claims, faster return-to-work scenarios, and increased margins for NUCA contractors. Contractors in similar programs have seen an average drop of 0.11 in their EMOSs through participation and utilization of captive programs and services.

The financial benefits of a captive program are well-documented. NUCA Assurance gives members the opportunity to access group purchasing power for excess markets, contractor’s professional insurance, and pollution coverage. And after three years of membership, members become eligible to receive surplus distributions based on their performance and the captive’s performance for those years. This built-in financial incentive motivates all captive members to control risk and share in the benefit of reduced claims.

NUCA Assurance is managed by CIRCA Managers, a construction-focused, captive-management firm with over 20 years of both direct claims-handling and risk-management expertise.

NUCA Assurance serves NUCA members only. An ideal candidate has an engaged leadership team, is financially sound, has been in business for at least five years, has a proven history that outperforms the industry loss averages, has a strong risk-control or safety program, and is committed to NUCA’s long-term goals.

Discover what NUCA Assurance could mean for your business operations. Visit www.nucaassurance.com and fill out the “Learn More” form to receive a personalized analysis by our experts on how this program can improve your insurance position.

Details about NUCA Assurance can also be obtained through NUCA’s preferred agency partner McGriff. Please contact program specialists Brian Dowling (bdowling@mcgriff.com) or Michael Larson (Michael.Larsen@mcgriff.com), and mention that you are a NUCA member.

Robert Baylor is the NUCA Director of Communications Tags: Insurance, January/February 2023 Print Issue, NUCA